2022 Schedule Eic

If you're looking for 2022 schedule eic pictures information linked to the 2022 schedule eic keyword, you have come to the right site. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

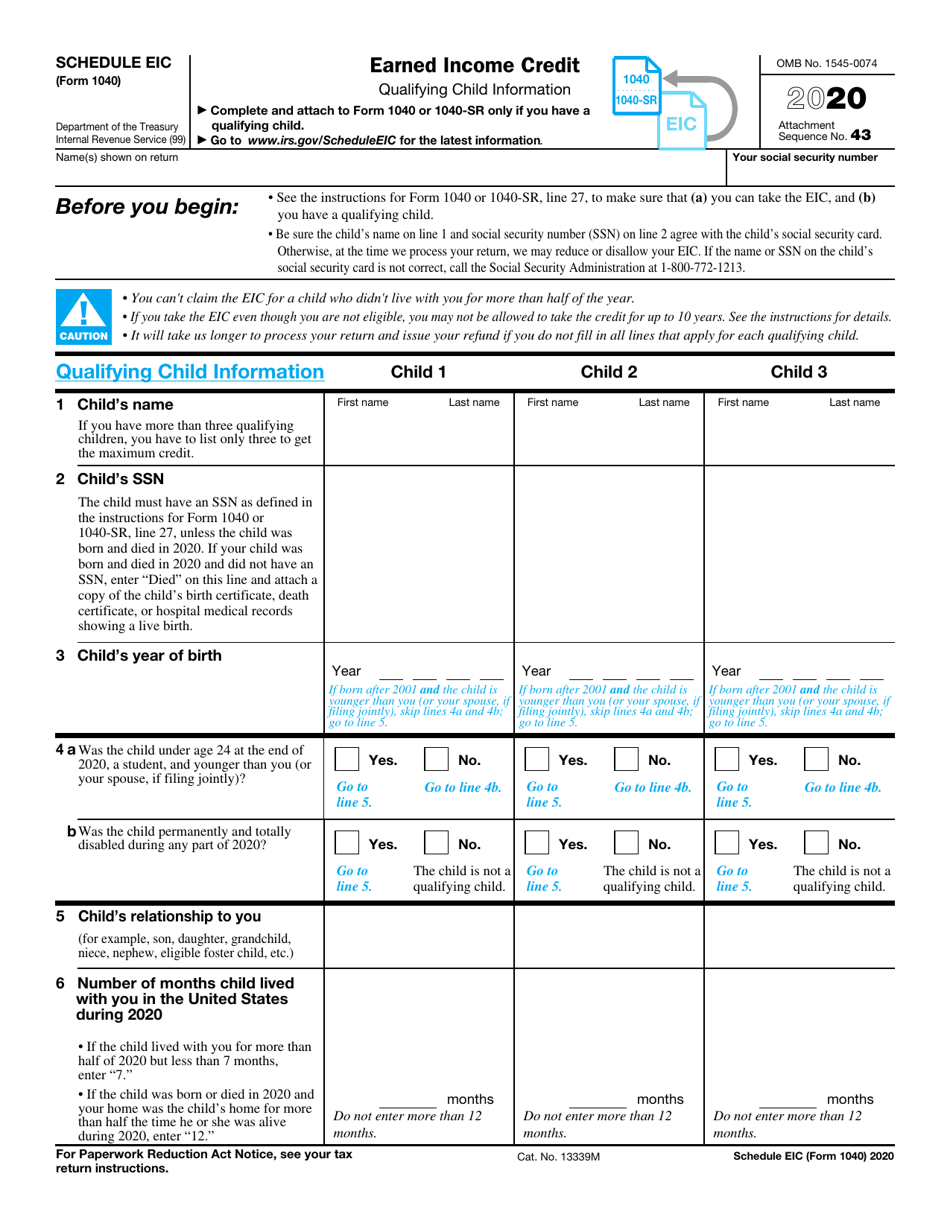

2022 Schedule Eic. For tax year 2021 (filed in. Below is the estimated 2022 irs tax refund schedule, showing the projected date you will likely receive your refund based on when you filed your tax return.

For tax year 2021 (filed in. Department of the treasury internal revenue service publication 596 cat. For example, you may earn $47,915 ($53,865 if married filing jointly) with two eligible children.

Under the biden arpa package, the eitc was temporarily modified to provided greater coverage for childless workers and also boost the maximum credit in 2021 to $1,502 from the already inflation adjusted $543 for childless workers.the benefit will be realized in larger refunds when taxpayers file their 2021 returns in.

Under the biden arpa package, the eitc was temporarily modified to provided greater coverage for childless workers and also boost the maximum credit in 2021 to $1,502 from the already inflation adjusted $543 for childless workers.the benefit will be realized in larger refunds when taxpayers file their 2021 returns in. 2019 1040 instructions (see eic line instructions) the schedule eic form is generally updated in december of each year by the irs. The earned income tax credit is available to taxpayers with low and moderate incomes. The credit decreases the amount of tax.

If you find this site {adventageous|beneficial|helpful|good|convienient|serviceableness|value}, please support us by sharing this posts to your {favorite|preference|own} social media accounts like Facebook, Instagram and so on or you can also {bookmark|save} this blog page with the title 2022 schedule eic by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.