2022 Schedule D Instructions

If you're looking for 2022 schedule d instructions pictures information linked to the 2022 schedule d instructions interest, you have visit the right blog. Our site frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

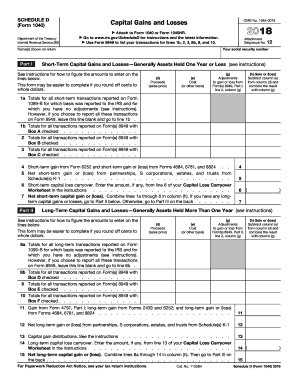

2022 Schedule D Instructions. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers…. Enter the smaller of line 2 or line 3b:

Turn them into templates for numerous use, add fillable fields to gather recipients? Enter the loss from your 2020 schedule d, line 21, as a positive amount: Make use of a digital solution to develop, edit and sign contracts in pdf or word format online.

If the original return was filed on time without making

D & e less cols. Capital gains and losses 2017 schedule d caution: _____ if line 7 of your 2020 schedule d is a loss, go to line 5; To elect out of the installment method, report the full amount of the gain on form 8949 for the year of the sale on a return filed by the due date (including extensions).

If you find this site {adventageous|beneficial|helpful|good|convienient|serviceableness|value}, please support us by sharing this posts to your {favorite|preference|own} social media accounts like Facebook, Instagram and so on or you can also {bookmark|save} this blog page with the title 2022 schedule d instructions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.