2022 Irs Schedule D

If you're looking for 2022 irs schedule d pictures information connected with to the 2022 irs schedule d topic, you have come to the ideal site. Our website frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

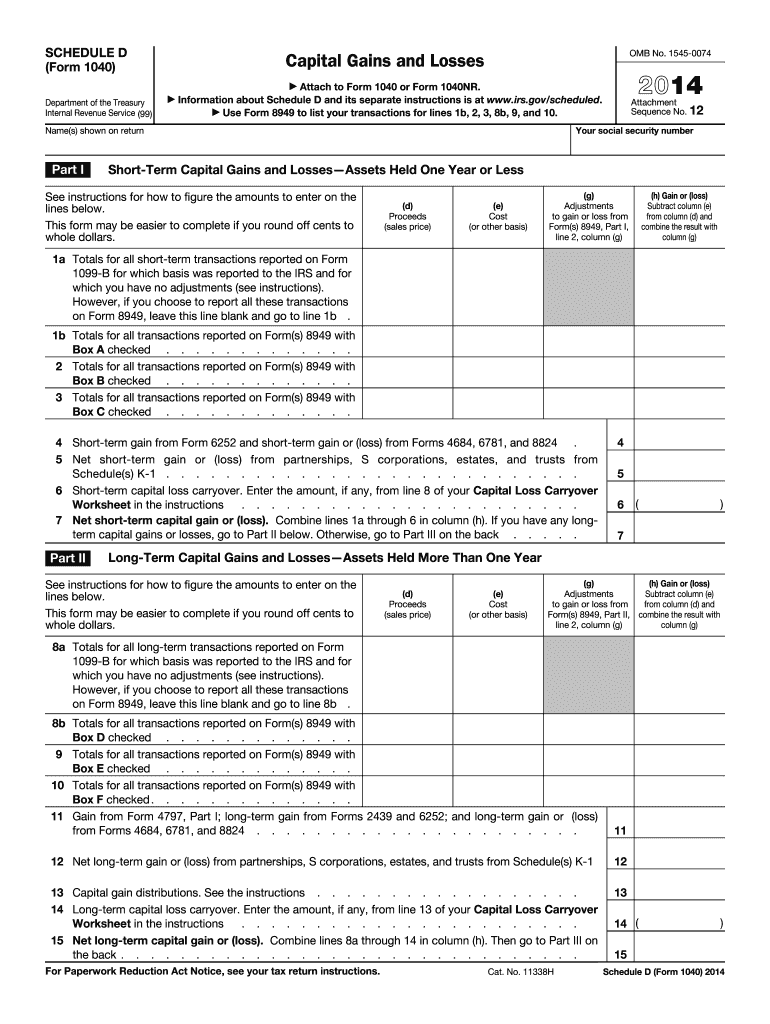

2022 Irs Schedule D. The irs schedule d form and instructions booklet are generally published in december of each year. Use schedule d to report sales, exchanges or some involuntary conversions of capital assets, certain capital gain distributions, and nonbusiness bad debts.

Capital asset defined requirements to file irs schedule d. Most of the time, you’ll receive money back due to the overage you’ve likely paid to the federal government over the course of the year. Secure and trusted digital platform!

Approve forms by using a lawful electronic signature and share them through email, fax or print them out.

Observe the short guideline so that you can complete irs 2022 irs 1065, stay clear of errors and furnish it in a timely manner: Last year, many of the federal income tax forms were published late in december, with instructions booklet following in early january due to last minute legislative changes. Even so, until finally 1986, the company reached among its main objectives: The irs schedule d form and instructions booklet are generally published in december of each year.

If you find this site {adventageous|beneficial|helpful|good|convienient|serviceableness|value}, please support us by sharing this posts to your {favorite|preference|own} social media accounts like Facebook, Instagram and so on or you can also {bookmark|save} this blog page with the title 2022 irs schedule d by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.